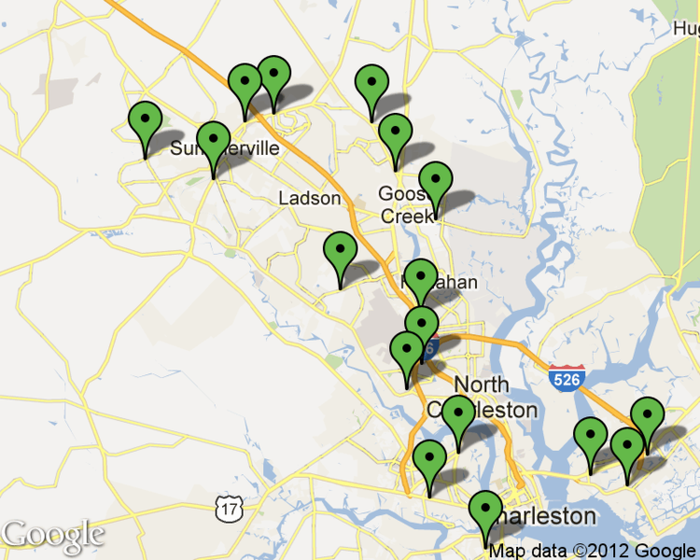

CHARLESTON, SC – H&R Block, the nation’s largest tax services provider, is launching its Money Express service today with grand openings at 17 existing H&R Block locations in and around the city’s core.

Money Express is a smart alternative to traditional banking services. Using a self-serve financial kiosk, which is similar in size to a traditional ATM, and an H&R Block Emerald Prepaid MasterCard® clients can easily pay bills, print money orders, load check funds directly to an H&R Block Emerald Prepaid MasterCard®, even add cell phone minutes. Each Money Express location will be open year-round and is conveniently located where Charleston residents live and work.

“Pre-paid debit cards are becoming increasingly important to consumers because of their convenience,” said Shannon Utsey, district manager for H&R Block. “Combined with the industry-leading H&R Block Emerald Prepaid MasterCard®, Money Express is a wise consumer choice to alternative banking methods.”

60 million remain unbanked or underbanked

Industry studies show that more than 1 in 3 households remain underserved by the traditional banking industry.1 Nationwide, 60 million adults are either unbanked or underbanked. Additionally, another 12.5 million households use alternative financial services such as payday loans, money orders, or check cashing services for convenience reasons.

Money Express has several attractive free services currently not found in the marketplace for prepaid card consumers:

- Free Emerald Card application and activation (including no monthly usage fees)

- Free cash withdrawals

- Free cash reload

In addition, H&R Block has secured unique partnerships with a variety of national and local retailers in Charleston to provide up to $100 of free cash rewards.

Money Express more than check cashing

Charleston resident Samantha Hutto knows firsthand the savings and convenience Money Express provides. The mother of three estimates she can save about $300 a year over her previous banking method since Money Express has no monthly fees or overdraft charges and low fees for bill payments.

“Where I worked didn’t have direct deposit. Money Express made it so easy and convenient to deposit my regular payroll checks directly onto my Emerald Card,” Hutto said. “I’ve used the Emerald Card for a few years and now with Money Express, I would never go back to a traditional bank.”

Money Express clients pay no monthly fees and pay an industry-low 1 percent for payroll and government check processing.

“Money Express is so much more than check cashing. It provides great benefits and value when you look at the array of services at lower costs than similar alternatives,” Utsey said. “We are proud to bring this one-of-a-kind service to the residents of the Low Country.”

To find a Money Express location near you call 800-HRBLOCK or check out www.gomoneyexpress.com.

About H&R Block

H&R Block, Inc. (NYSE: HRB) is the world's largest tax services provider, having prepared more than 600 million tax returns worldwide since 1955. In fiscal 2012, H&R Block had annual revenues of $2.9 billion and prepared 25.6 million tax returns worldwide. Tax return preparation services are provided in company-owned and franchise retail tax offices by nearly 100,000 professional tax preparers, and through H&R Block At Home™ digital products. H&R Block Bank provides affordable banking products and services. For more information, visit the H&R Block Online Press Center.

Money Express

All products and services offered through H&R Block Money Express are provided by Nexxo Financial, Inc. An H&R Block Emerald Prepaid MasterCard is required to use these services. The H&R Block Emerald Prepaid MasterCard is issued by H&R Block Bank, a Federal Savings Bank, Member FDIC, pursuant to a license from MasterCard International Incorporated. Additional fees, terms and conditions apply. MasterCard is a registered trademark of MasterCard International Incorporated. Not available at all locations and to all applicants. Consult your cardholder agreement for details on fees, terms and conditions. ©2012 HRB Tax Group, Inc.