Frequently, Workplace Benefits employer clients will ask…how do I figure out my employees’ deductions for their health insurance?

It’s a fairly simple formula to follow depending on how your company is structured.

Take the total employee only premium. Let’s say in this example, it’s $359.03.

Subtract the amount that the employer contributes. In this example, the employer pays $200 of the total employee only cost.

- If you pay a percentage, you will need to calculate that percentage and subtract that amount

- If the employee has dependents, you will need to add in the total dependent cost here and follow the remainder of the formula

- If you have additional benefits that need to be deducted, add them in here and follow the rest of the formula.

In this case, it leaves you with $159.03.

Also, this company pays bi-weekly. So we will need to take $159.03 and multiply it by 12 (months in the year) and divide by 26 (number of pay periods).

Therefore the bi-weekly deduction would be $73.39.

- If you pay bi-monthly, divide by 24.

- If you pay weekly, divide by 52.

Workplace Benefits advises that you set up a spreadsheet and create the formula for each cell. It will make your administration for this process much easier.

It doesn’t have to be overwhelming, just nail down the process and you will find it seamless and systematic.

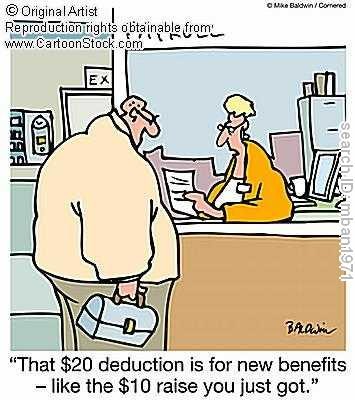

As far as living paycheck to paycheck…well, we can’t really help you with that!